UNLOCKING OPPORTUNITIES: WHY DIASPORA SHOULD INVEST IN KENYA

Kenya is often referred to as the “Gateway to East Africa”. One group that holds significant potential to drive economic growth and development in Kenya is our diaspora. At our recent Webinar, #SBMDiasporaConnect, we had Kenyans connecting to us from all over the world. Kenyans are spread across the globe and their financial and intellectual capital can be harnessed to boost the nation’s economy.

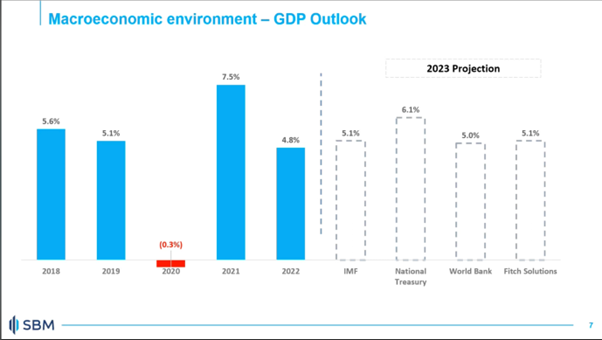

Kenya has historically been one of Africa’s fastest-growing economies, boasting a relatively stable macroeconomic environment.

The country’s GDP has consistently outperformed the regional average thanks to a diversified economy with strong sectors such as agriculture, financial services, manufacturing and technology.

The shilling will continue to come under pressure in 2023 but is expected to be supported by Diaspora Remittances into the country.

Thriving Technology & Innovation:

Nairobi has earned the nickname “Silicon Savannah” due to its burgeoning tech and innovation ecosystem. The city is home to numerous tech startups, incubators and accelerators, attracting investors and entrepreneurs from around the world. The tech landscape is making significant strides in various sectors including Fintech, Health-tech and agritech.

Interestingly, Kenya is ranked second in Africa for Cryptocurrency ownership with 6.1 million Kenyans owning Crypto currencies. From a global perspective, Kenya is ranked in the top 10.

According to our experts, the most lucrative current investment opportunities in Kenya are listed below:

Money Markets:

Treasury Bills are issued by the government and have a tenure of less than 1 year. The taxes on Treasury Bills are on a 15% withholding tax. The amount of money you invest will already take into account the return. Minimum investment in KES 100,000/- and you will need a CDS account.

Commercial Papers are issued by Private Companies interested in raising funds; tenure of up to 1 year. The interest will be subjected to taxation (they range between 15-30%, with 15% being withheld). They do not require you to have a CDS account.

Fixed Deposits are issued by commercial banks like SBM Bank, typically 1 year with various interest rates. You may speak to our Diaspora team to learn more.

Fixed Income Securities:

Treasury Bonds are issued by the government with papers ranging from 2 years to up to 30 years or longer. Any paper with a tenure of 10 years and above has a reduced withholding tax rate of 10%. The Government also issues infrastructure bonds which are tax free on the interest received.

Corporate bonds are issued by Private Corporate Entities with more information available on the Nairobi Stock Exchange Website.

Euro Bonds are instruments issued by foreign governments allowing foreign investors to invest. Local citizens are not eligible to participate in these though Diaspora may invest if they do so from another country. SBM Bank Kenya is able to facilitate this through their Mauritius presence.

Stocks and Shares:

Purchase of stocks listed on the NSE as well as private listings. Stock prices are currently at their lowest which suggests a favourable time for buyers to invest in the hopes that prices will rise as the economy strengthens its position. There will be a significant capital gain from selling these stocks in the future.

Real Estate & Infrastructure:

Kenya’s urbanization rate is on the rise leading to an increase in demand for housing and infrastructure and land.

There are currently a lot of properties on the market, demand to buy is low, therefore, investors stand to gain from the appreciation of property values and rental income.

In terms of taxes; those engaging in rental business with annual income of KES 15M and below are required to pay 10% in taxes. From January that will be reduced to 7.5%. For annual income of 15M + you are required to pay the standard corporate tax of 30%

Investing in Kenya can be a win-win situation for the Kenyan diaspora and the nation itself. By harnessing your financial resources, expertise, and cultural connection, you can play a pivotal role in driving economic growth, creating jobs and contributing to the development of Kenya.

Talk to one of our Diaspora Relationship Managers, who are available 24/7 365 days of the year and become part of Kenya’s exciting journey towards prosperity.