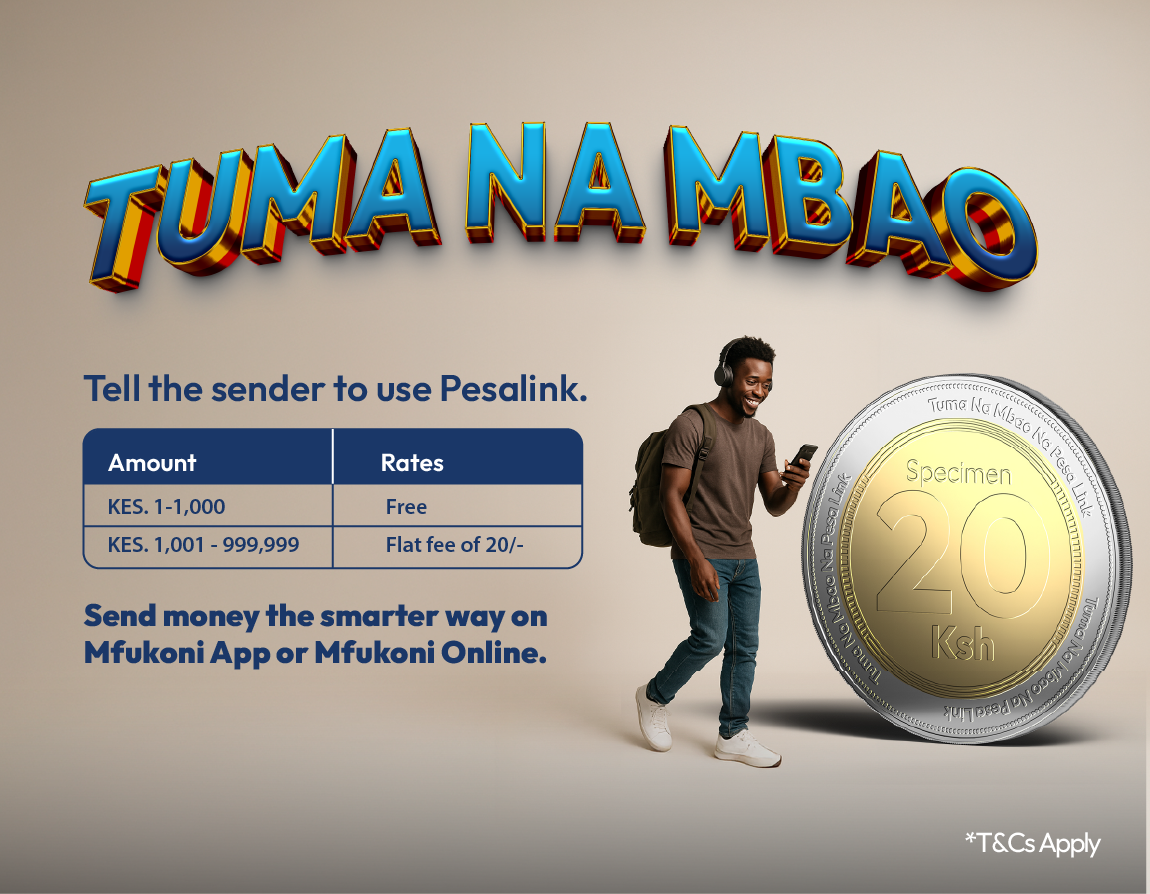

Tuma na Mbao, Save More: How SBM Bank and Pesalink Are Changing the Way Kenyans Transfer Money

Have you ever stopped to think about how much those little transfer fees add up? For many Kenyans, sending money is a regular part of life. Whether it’s the monthly allowance to family upcountry, a school contribution, or paying suppliers for a small business, every transaction chips away at hard-earned shillings.

But what if sending money didn’t have to cost so much? What if those extra shillings stayed in your pocket instead of going to fees? Thanks to a powerful partnership between SBM Bank Kenya and Pesalink, this is now possible. Together, they are championing convenience, affordability, and financial empowerment for Kenyans everywhere.

.png)

Affordable Transfers That Make Sense

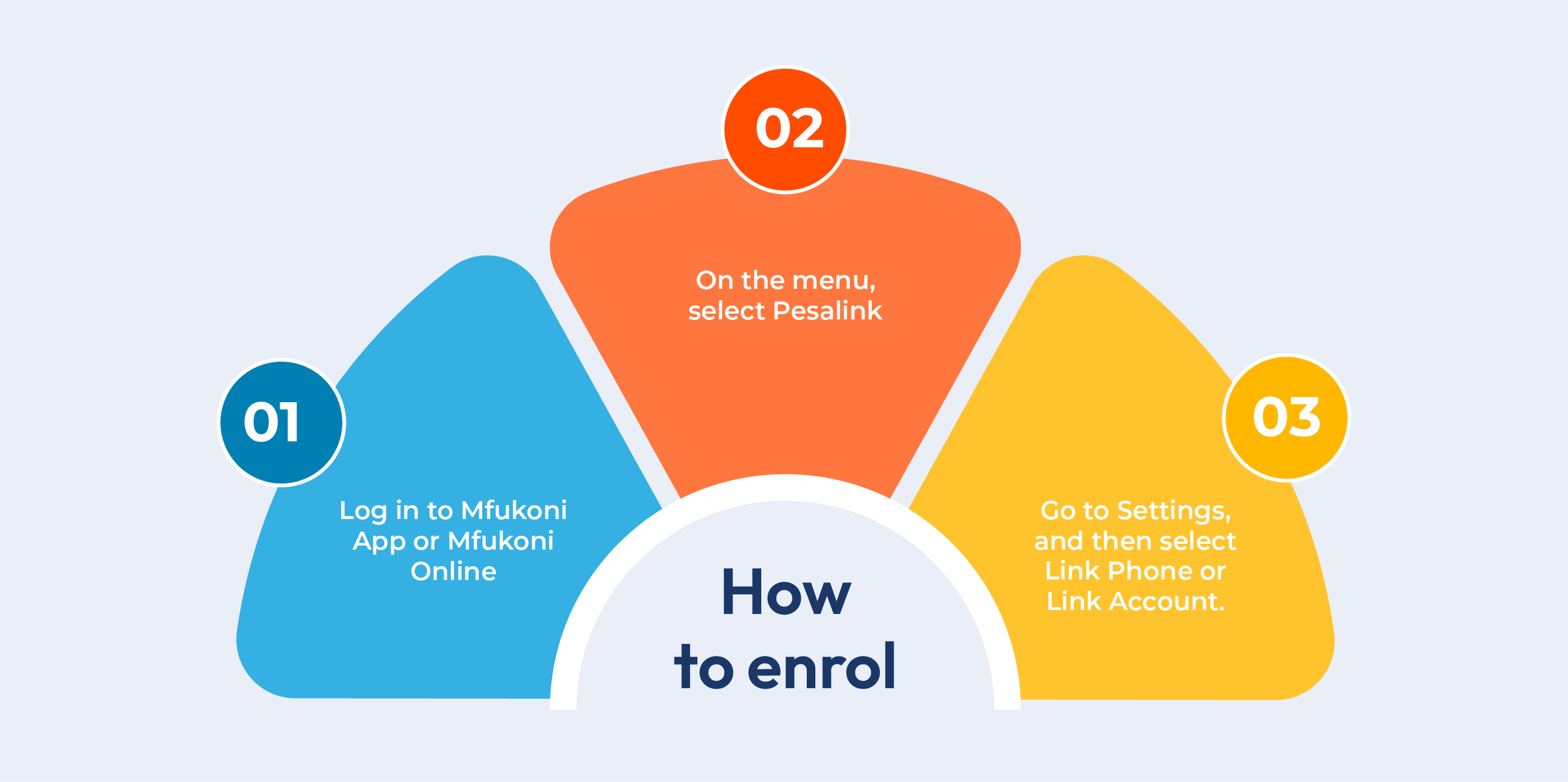

Through the SBM Mfukoni app and online banking, customers can now enjoy some of the lowest transfer charges in the market. Here’s how it works:

- Transfers between KSh 1 and KSh 1,000 → Absolutely free

- Transfers between KSh 1,001 and KSh 999,999 → Flat KSh 20 fee

Yes, you read that right. Just 20 bob, no matter the amount (as long as it’s under a million shillings). To put that in perspective, that’s cheaper than your daily avocado or even a bag of chips.

This new structure completely transforms the way Kenyans think about sending money. No hidden costs, no tiered surprises - just a simple, affordable, and transparent model.

Why Does This Matter?

For the average Kenyan, these fees represent potential savings and opportunities lost. Think about a typical household’s monthly transactions.

Imagine you send KSh 50,000 to your parents and KSh 15,000 to a niece in school. Previously, you might have paid anywhere from KSh 200 to 300 in transfer charges. With SBM and Pesalink, that’s just KSh 40 total - a massive difference.

Those saved shillings can go toward school fees, household shopping, or even small investments. Over time, the savings add up, building stronger financial security for families.

A Game Changer for Businesses

The benefits are not just for individuals but also for entrepreneurs and SMEs. Consider a boutique designer paying artisans and transporters across different counties. Ten payments of KSh 25,000 each could previously cost hundreds of shillings in fees. Now, it’s just KSh 20 per transaction - predictable, flat, and affordable.

For businesses, every saved shilling counts. Lower transfer costs mean:

- More affordable bulk payments to suppliers and staff

- Easier salary disbursements for SMEs and startups

- Reduced operational costs, improving cash flow

This affordability can significantly reduce the burden on small businesses and encourage more digital transactions, boosting financial inclusion across the country.

Instant, Secure, and Always Available

Affordability is only part of the story. The real-time, 24/7 availability of Pesalink is equally powerful. Unlike traditional transfers that may be delayed by bank cut-off times, weekends, or public holidays, Pesalink is always on.

This means:

- No waiting for banking hours

- No delays in emergencies

- Seamless payments at any time, day or night

It’s fast, secure, and dependable - qualities that every Kenyan needs when handling money. For families, this provides peace of mind. For businesses, it ensures smooth operations without disruptions.

Shaping Better Financial Habits

By significantly lowering costs, the SBM–Pesalink initiative also nudges Kenyans toward better financial management habits. Each transaction becomes an opportunity to save, and those savings can be redirected toward goals such as:

- Starting an emergency fund

- Investing in chamas, saccos, or unit trusts

- Paying off debts faster

- Supporting small entrepreneurial ventures

It’s about more than just moving money. It’s about creating a culture of cost-conscious, smarter financial decisions that support long-term growth.

Why Pay More?

Here’s a simple question: Why pay KSh 60, 80, or even 100 in fees when KSh 20—or even zero - can do the same job?

That’s the powerful choice SBM Bank Kenya and Pesalink are offering. By embracing these platforms, you’re not just saving money - you’re also gaining access to a system built for the modern Kenyan lifestyle.

Whether you’re a student sending pocket money, a parent supporting your household, or a business owner managing multiple payments, this solution works in your favour.

Financial Inclusion in Action

This partnership is also about financial inclusion. By making money transfers cheaper and always accessible, SBM and Pesalink ensure that more Kenyans can participate fully in the formal banking system.

Even diaspora remittances benefit. For small amounts - like sending under KSh 1,000 to a relative at home - fees are completely waived. This means families can receive funds without worrying about deductions eating into the amount.

Such inclusivity strengthens Kenya’s overall financial ecosystem, encouraging digital adoption and trust in formal banking channels.

The SBM–Pesalink Advantage

Here’s why Kenyans should consider switching today:

- Zero fees on transfers below KSh 1,000

- Flat KSh 20 fee on transfers up to KSh 999,999

- 24/7 availability, including weekends and holidays

- Secure and instant transactions via the SBM Mfukoni app or online banking

- Affordable for individuals, businesses, and diaspora users

This is not just about making payments - it’s about changing financial habits, encouraging savings, and ensuring money works harder for you.

Send Smarter, Save More

In Kenya, sending money is not a luxury - it’s part of daily life. From remittances to suppliers to school fees, these transactions touch every household and business.

With SBM Bank Kenya and Pesalink, those costs no longer have to be a burden. Instead, you can enjoy an affordable, transparent, and convenient way of moving money.

So next time you open your app to send funds, ask yourself: Why pay more when you can Tuma na mbao and save the rest?

With SBM and Pesalink, the answer is clear: send smarter, save more, and take a step closer to financial growth.